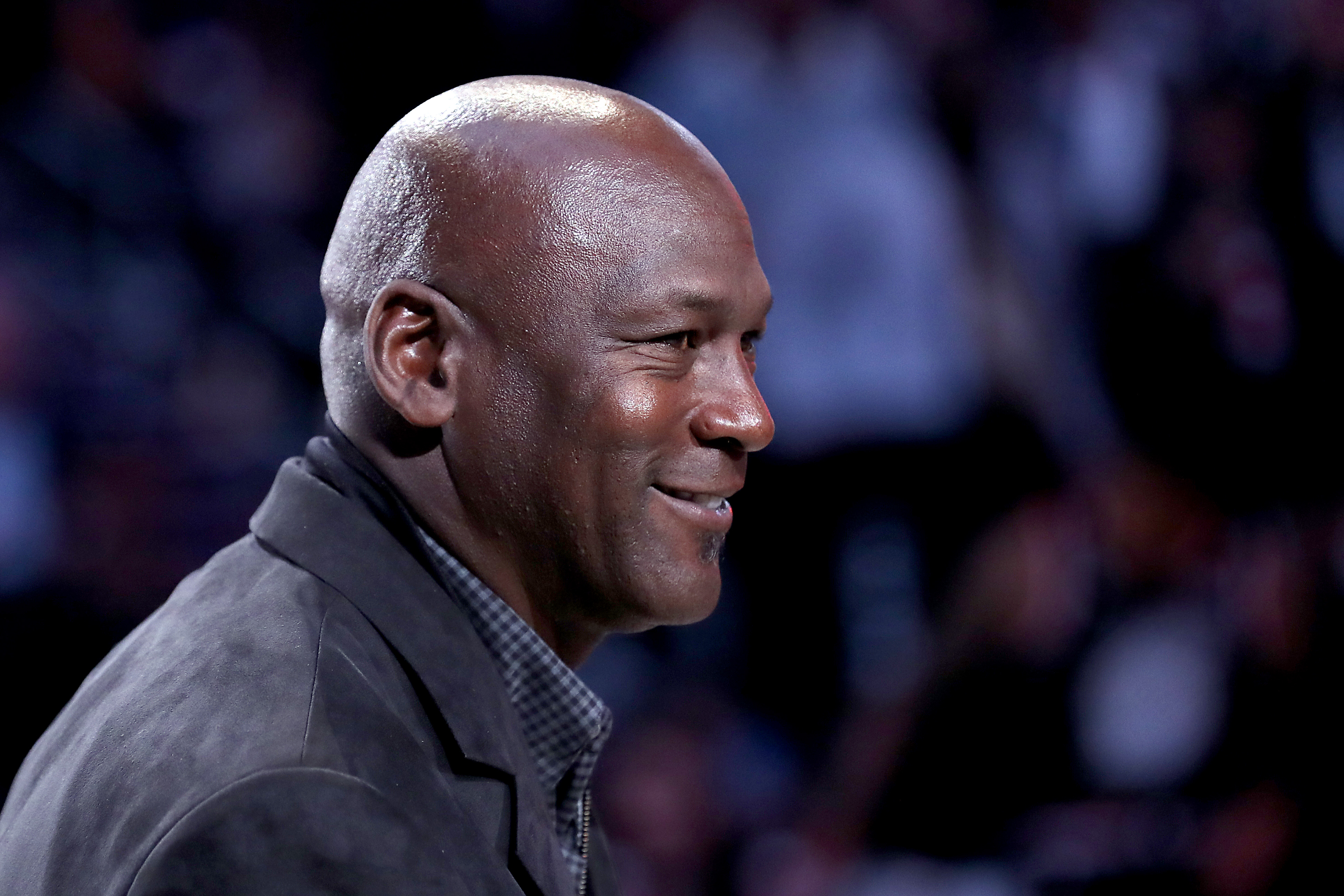

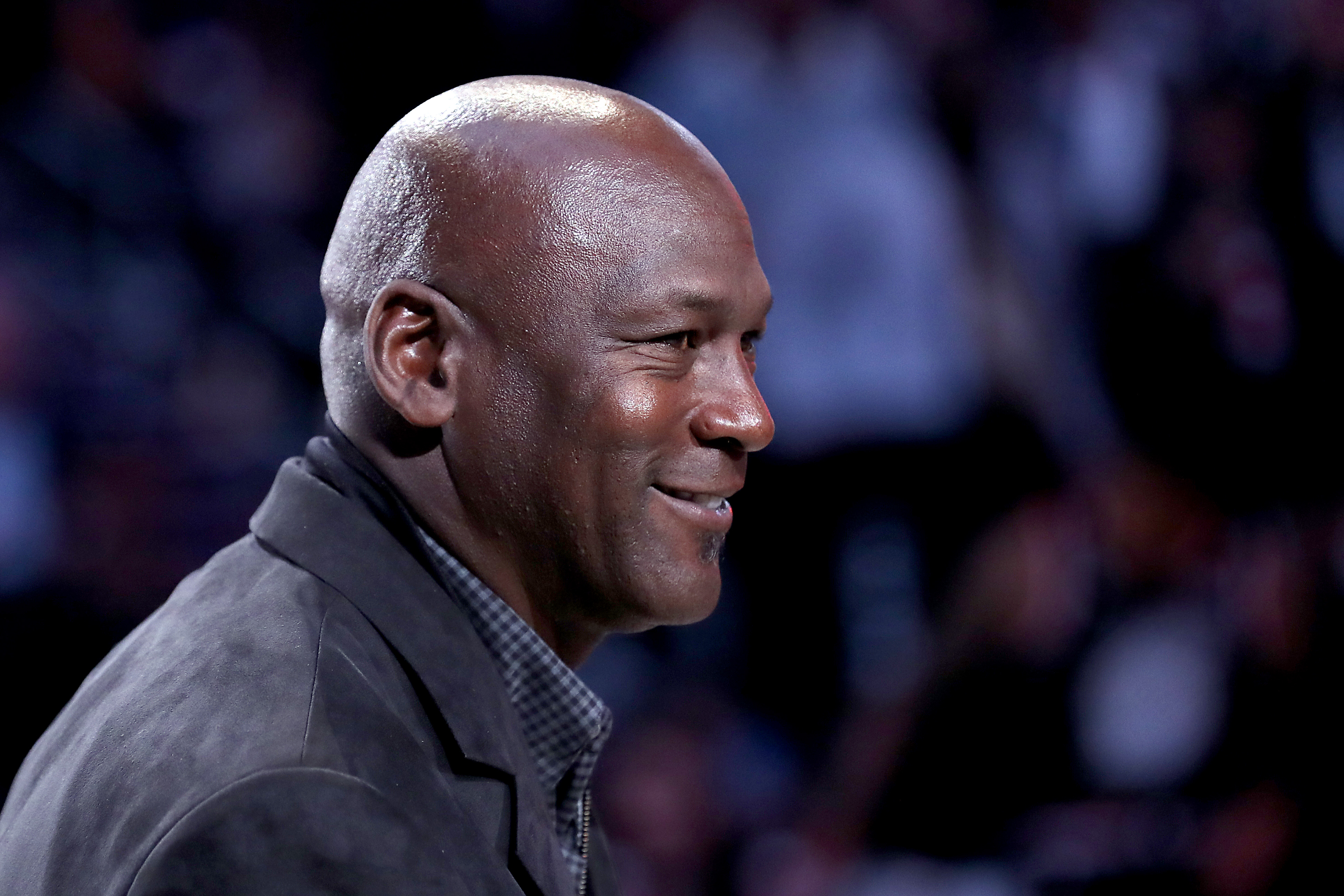

Davvero? 21+ Fatti su Melvin Capital Founder Gabe Plotkin: Plotkin was able to be picky about which investors' cash he took, and would lock up money for longer than most other equity hedge funds.

Melvin Capital Founder Gabe Plotkin | Melvin capital founder gabe plotkin made the disturbing claim in prepared testimony he plans to deliver at thursday's house financial services committee hearing on the recent populist revolution in the stock market. Melvin capital — which plotkin named after his grandfather — closed its short. As per an article by gabe. Until now, melvin capital has returned a regular 30% annually (44% in 2019). Gabriel plotkin net worth 2021:

This is unsurprising given its genealogy. Melvin capital founder gabriel (gabe) plotkin is a former portfolio manager who worked for steven cohen (then sac capital management). Everything to know about melvin capital owner. Melvin's founder, gabe plotkin, was one of the people brought in to testify before congress about the volatile market moves, along with citadel's ken griffin i think us at melvin, we'll adapt and i think the whole industry will have to adapt, plotkin said. Gabriel plotkin net worth 2021:

Starting as a portfolio manager at sac capital, gabriel plotkin is the cio and founder of melvin well, there is minimal information about gabriel plotkin on the internet. He will stay with the company, but transition from his current role of cio, to retail staff. Melvin capital founder gabriel (gabe) plotkin is a former portfolio manager who worked for steven cohen (then sac capital management). However, gamestop will continue to employ melvin capital's founder gabe plotkin. As per an article by gabe. It was founded in 2014 by gabriel plotkin. Everything to know about melvin capital owner. It ended the month with more than $8 billion after receiving commitments from current investors for more capital in the final days of the month, the source said. Melvin capital founder gabe plotkin made the disturbing claim in prepared testimony he plans to deliver at thursday's house financial services committee hearing on the recent populist revolution in the stock market. Melvin capital declined to comment to cnbc. In march, gabe plotkin's melvin capital took a step back from digging itself out of its gamestop hole. Gabriel plotkin, the founder and chief investment officer of melvin capital management, one of the hedge funds at the center of the gamestop saga, is expected to explain to lawmakers why his firm had been short on the stock years before garnering national attention. We have great confidence in gabe and his team, said ken griffin, founder and ceo of citadel.

Melvin capital was founded by gabe plotkin, and it started the year with roughly $12.5 billion in assets. Melvin capital — which plotkin named after his grandfather — closed its short. The fund now manages $13 billion. An extended interview with gabe plotkin of melvin capital, the short seller of gamestop, on achieving success in the hedge fund business.due in part to his. As per an article by gabe.

The hedge fund firm with $3.5 billion under management. According to forbes , plotkin earned about $300 million in compensation in 2017, making. Melvin fell as much as 53% in january in a short squeeze fueled by users of. Actively losing money since monday 25th january 2021. Plotkin was able to be picky about which investors' cash he took, and would lock up money for longer than most other equity hedge funds. However, gamestop will continue to employ melvin capital's founder gabe plotkin. Gabriel plotkin, the founder and chief investment officer of melvin capital management, one of the hedge funds at the center of the gamestop saga, is expected to explain to lawmakers why his firm had been short on the stock years before garnering national attention. Melvin capital founder, gabriel plotkin's, testimony before the house committee on financial services regarding the recent gamestop short sell. Melvin capital's mistake, if it can be called that, was leaving footprints behind in the marketplace. It was founded in 2014 by gabriel plotkin. As per an article by gabe. Before he founded melvin, plotkin worked. Due to this job change, gabe will relocate to mill hall, pa, working at store 7513.

Next up is gabe plotkin of melvin capital management who talked markets. He will stay with the company, but transition from his current role of cio, to retail staff. Gabriel plotkin, the founder and chief investment officer of melvin capital management, one of the hedge funds at the center of the gamestop saga, is expected to explain to lawmakers why his firm had been short on the stock years before garnering national attention. We have great confidence in gabe and his team, said ken griffin, founder and ceo of citadel. According to forbes , plotkin earned about $300 million in compensation in 2017, making.

Melvin fell as much as 53% in january in a short squeeze fueled by users of. Plotkin was able to be picky about which investors' cash he took, and would lock up money for longer than most other equity hedge funds. Everything to know about melvin capital owner. The couple spend most of their time either in new york or florida. Melvin capital — which plotkin named after his grandfather — closed its short. He will stay with the company, but transition from his current role of cio, to retail staff. Gabe plotkin melvin capital sohn new york conference notes presentation. Cnbc's andrew ross sorkin revealed melvin capital has sold all of its shares in gamestop during the network's squawk box programme, following a conversation he had with the fund's manager gabe plotkin. Gabe plotkin founded melvin capital in 2014; The $8 billion equity hedge fund lost 7% last after january, when melvin lost 53% and received $2.75 billion in new money from steve cohen — the founder of point72 and plotkin's former boss. In march, gabe plotkin's melvin capital took a step back from digging itself out of its gamestop hole. Gabriel plotkin, the founder and chief investment officer of melvin capital management, one of the hedge funds at the center of the gamestop saga, is expected to explain to lawmakers why his firm had been short on the stock years before garnering national attention. Until now, melvin capital has returned a regular 30% annually (44% in 2019).

The $8 billion equity hedge fund lost 7% last after january, when melvin lost 53% and received $275 billion in new money from steve cohen — the founder of point72 and plotkin's former boss melvin capital plotkin. Gabe plotkin founded melvin capital in 2014;

Melvin Capital Founder Gabe Plotkin: He will stay with the company, but transition from his current role of cio, to retail staff.